Selecting the Best Policy for Long-Term Care Insurance

Be sure to carefully consider the possibilities and costs of long-term care insurance before making a purchase. Take a look at the coverage duration and daily benefit amount. Examine whether it provides inflation protection, which enables the policy to keep up with the escalating costs of healthcare. Examine estimates from several insurance companies while keeping an eye on your spending limit and financial objectives. Select the coverage that best suits your requirements.

Price

Reportage

Several policies for long-term care insurance provide varying degrees of coverage. A solid policy should shield your assets from the high expense of long-term care and assist you in avoiding depending on family members for financial support. A variable elimination time, inflation protection, and other elements must be included.

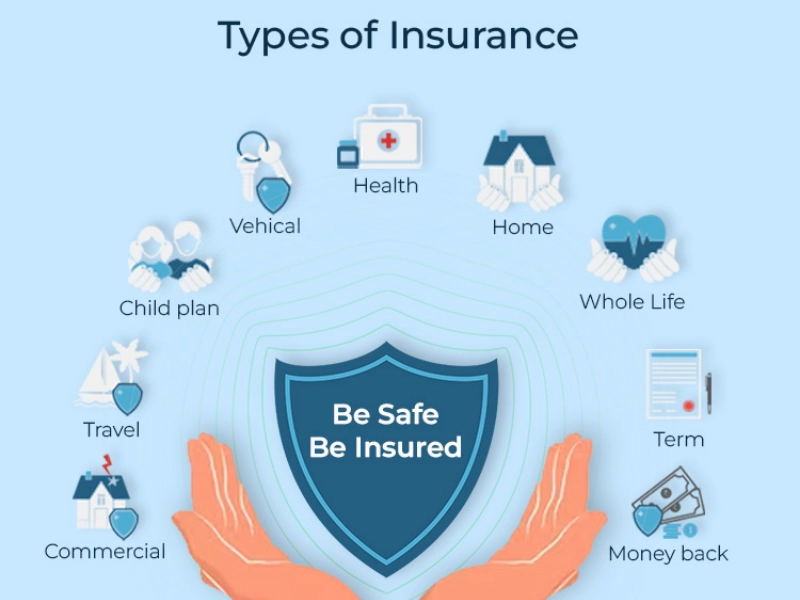

You can get this kind of coverage individually or by enrolling in a group plan that your association or business offers. You will typically have to go through medical underwriting, though. If you are in good health, you should purchase insurance as soon as possible to save money on annual premiums. A few companies sell hybrid packages that include long-term care insurance along with benefits from life insurance or annuities.

Several policies for long-term care insurance provide varying degrees of coverage. A solid policy should shield your assets from the high expense of long-term care and assist you in avoiding depending on family members for financial support. A variable elimination time, inflation protection, and other elements must be included.

You can get this kind of coverage individually or by enrolling in a group plan that your association or business offers. You will typically have to go through medical underwriting, though. If you are in good health, you should purchase insurance as soon as possible to save money on annual premiums. A few companies sell hybrid packages that include long-term care insurance along with benefits from life insurance or annuities.

Adaptability

Take into consideration the features and perks provided when looking for long-term care insurance. This will assist you in figuring out the appropriate level of coverage and price. A policy's maximum benefit duration and the ability to include inflation protection should also be taken into account.

Depending on the kind of coverage you select, a long-term care insurance policy can have quite different costs. Certain insurance policies have a predetermined benefit amount and a fixed premium. Some are offered as hybrid life insurance policies, while some require an elimination period. Since inflation protection boosts your coverage annually depending on either simple or compound inflation, it's a crucial element to take into account.

Take into consideration the features and perks provided when looking for long-term care insurance. This will assist you in figuring out the appropriate level of coverage and price. A policy's maximum benefit duration and the ability to include inflation protection should also be taken into account.

Depending on the kind of coverage you select, a long-term care insurance policy can have quite different costs. Certain insurance policies have a predetermined benefit amount and a fixed premium. Some are offered as hybrid life insurance policies, while some require an elimination period. Since inflation protection boosts your coverage annually depending on either simple or compound inflation, it's a crucial element to take into account.

Protection against inflation

Certain long-term care insurance policies come with an inflation protection feature that raises the policy's annual maximum. It usually results in a 5% simple or compound daily benefit improvement. Selecting a more advanced compounding rate will accelerate the policy's value growth.

This coverage aids in defending the insured against underinsurance, which may occur as medical expenses increase over time. It may, however, also raise the policy's cost. For this reason, it's crucial to think about whether you actually need this protection. Additionally, your premium can change depending on the kind of inflation protection you select.

Certain long-term care insurance policies come with an inflation protection feature that raises the policy's annual maximum. It usually results in a 5% simple or compound daily benefit improvement. Selecting a more advanced compounding rate will accelerate the policy's value growth.

This coverage aids in defending the insured against underinsurance, which may occur as medical expenses increase over time. It may, however, also raise the policy's cost. For this reason, it's crucial to think about whether you actually need this protection. Additionally, your premium can change depending on the kind of inflation protection you select.

Motorcyclists

Riders are a common feature in long-term care insurance coverage. These have the potential to lower premium costs or offer more coverage. They also provide you with the option to switch beneficiaries or alter the length of payouts. If you receive a significant chronic illness diagnosis, you may be eligible to receive a portion of your death benefit if you have a chronic illness. Spousal insurance, which allows spouses to share their coverage, is offered by some firms.

Purchasing a policy in your 50s or while you are examining your retirement plan with a financial counselor is advised by several experts. Usually, the premiums are less expensive now than they will be later. But you can also finance a long-term care policy with savings and other sources of income.

Riders are a common feature in long-term care insurance coverage. These have the potential to lower premium costs or offer more coverage. They also provide you with the option to switch beneficiaries or alter the length of payouts. If you receive a significant chronic illness diagnosis, you may be eligible to receive a portion of your death benefit if you have a chronic illness. Spousal insurance, which allows spouses to share their coverage, is offered by some firms.

Purchasing a policy in your 50s or while you are examining your retirement plan with a financial counselor is advised by several experts. Usually, the premiums are less expensive now than they will be later. But you can also finance a long-term care policy with savings and other sources of income.

Premiums

Purchasing long-term care insurance is a significant financial choice. Your options for coverage might be greatly impacted by the rates you pay. Your health state and the kind of care you require will also affect your premiums. Your rates will be lower the younger and healthier you are when you purchase insurance.

Selecting the appropriate policy might be challenging. Make sure the policy you select has a benefit duration that meets your demands and a daily benefit level that corresponds with your projected costs. Inflation protection can help your coverage keep up with escalating healthcare costs over time, so you should think about including it.

Purchasing long-term care insurance is a significant financial choice. Your options for coverage might be greatly impacted by the rates you pay. Your health state and the kind of care you require will also affect your premiums. Your rates will be lower the younger and healthier you are when you purchase insurance.

Selecting the appropriate policy might be challenging. Make sure the policy you select has a benefit duration that meets your demands and a daily benefit level that corresponds with your projected costs. Inflation protection can help your coverage keep up with escalating healthcare costs over time, so you should think about including it.